A payment processing system is the technical infrastructure that enables businesses to accept, authorise, process, and settle electronic payments. It connects merchants, customers, acquiring and issuing banks, and payment networks to manage the full transaction lifecycle, from capturing payment details and obtaining authorisation to clearing, settlement, and ledger recording, while supporting multiple payment methods, fraud controls, reporting, and API-based integrations.

Launch Your Own Payment Processing Business

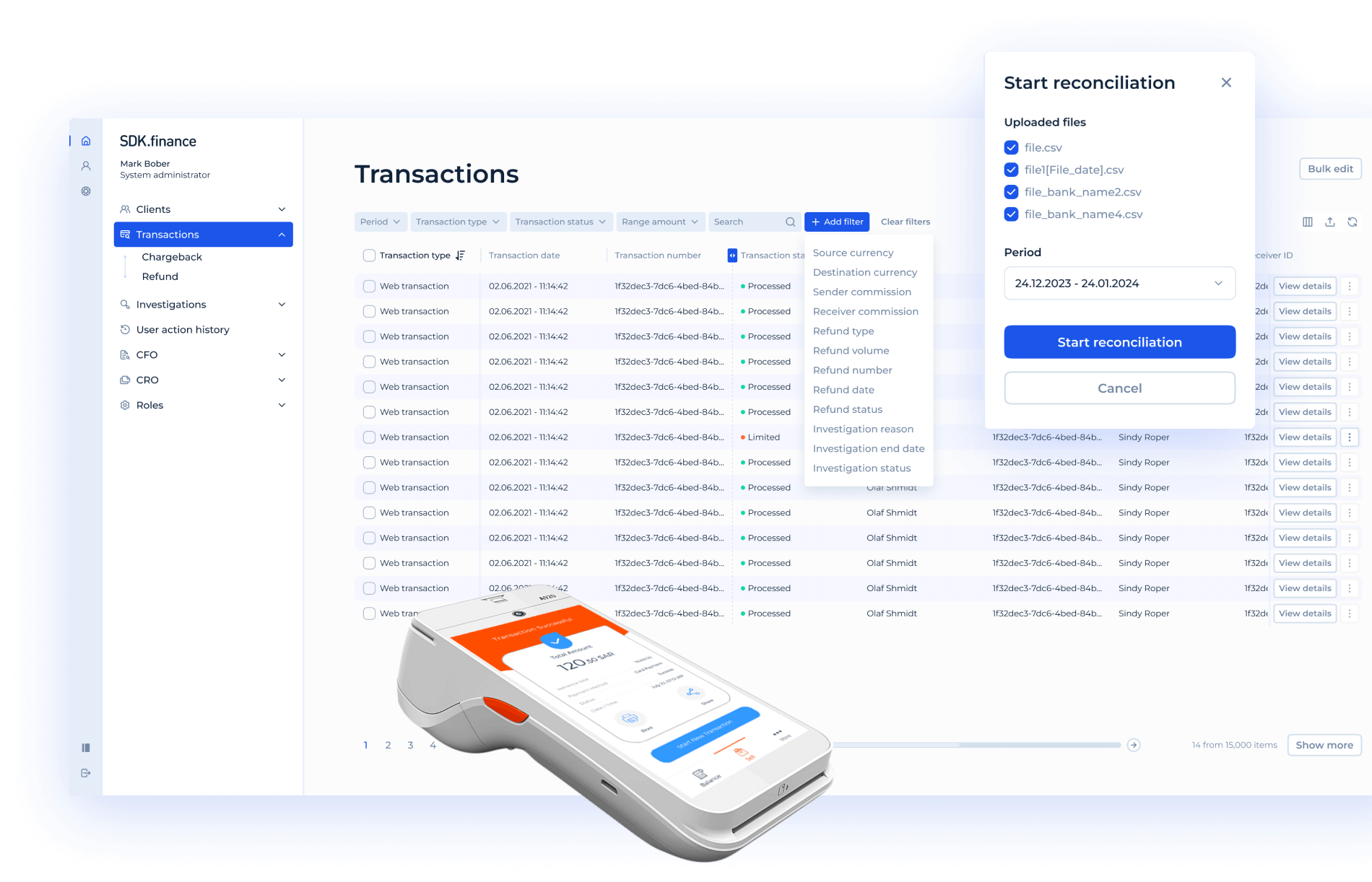

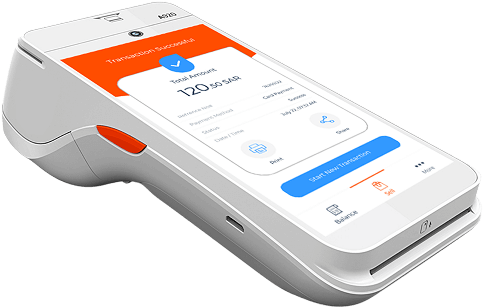

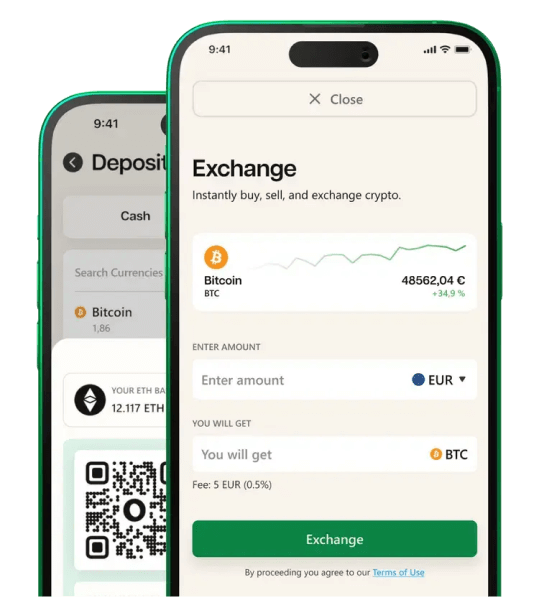

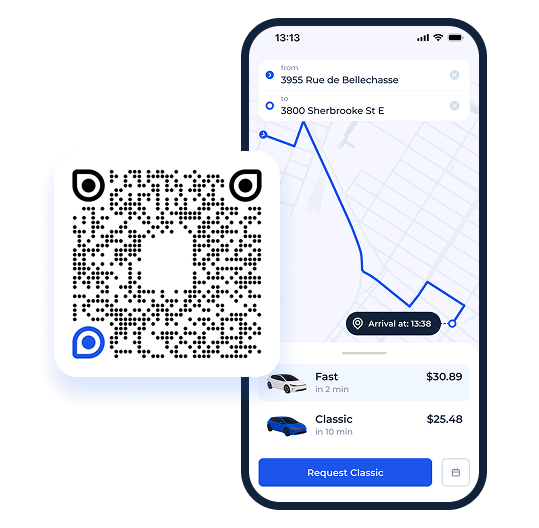

Become a Payment Service Provider (PSP) and offer merchant payment processing for both online and in-store transactions. Enable businesses to accept secure online payments via credit card processing software, bank transfers, and digital wallets, while also supporting POS terminals and QR code payments for in-store purchases. Launch your payment services quickly with our PCI DSS-compliant credit card processing software. No need to build from scratch.

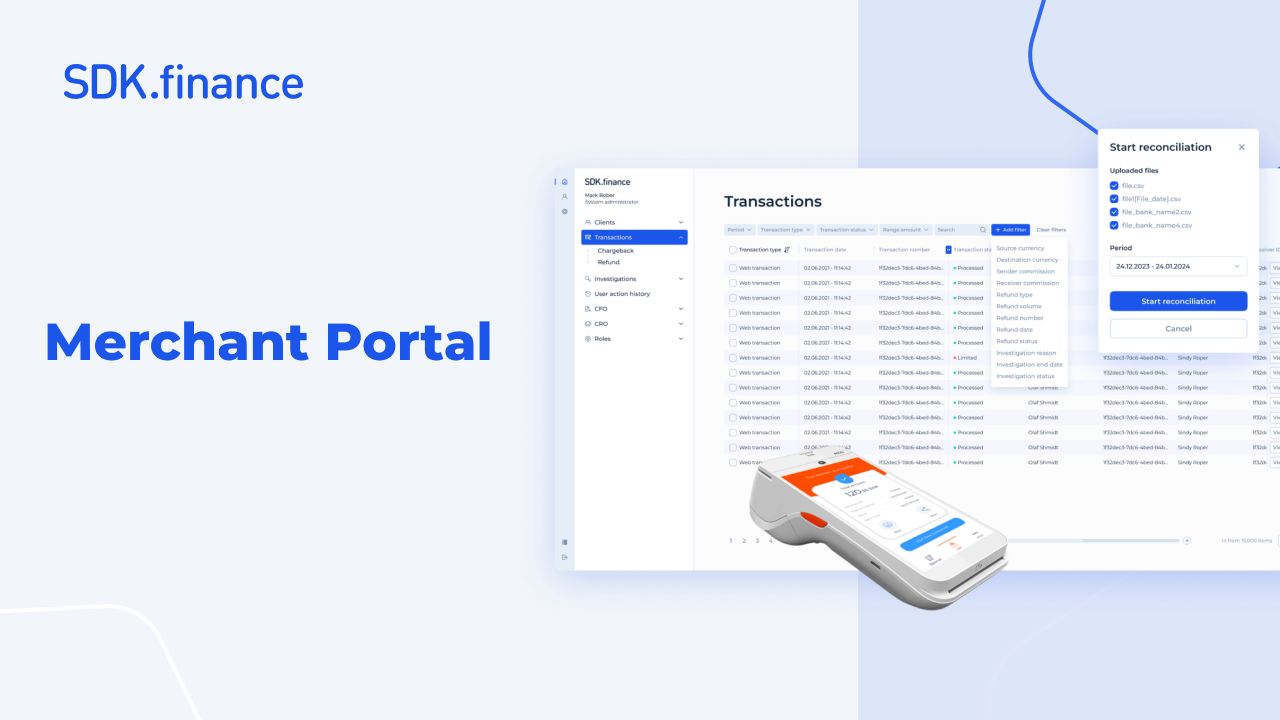

Contact usMerchant Portal Powered by SDK.finance

Explore this demo video to discover transactions and balance dashboard, stores management, money withdrawal process and other top features

The credit card processing software you need to build a world-class business

Catering to FinTech products for all business types

Empower various businesses, including online e-commerce marketplaces and brick-and-mortar stores, to accept payments through different channels.

Streamlined payment acceptance

Get maximum flexibility to customize the payment transaction flow and offer frictionless transaction processing both in-store and a secure payment gateway for online transactions.

Any currency, multiple channels

Support an unlimited number of currencies and let merchants accept card credit cards, process digital wallet transactions, and various payment methods.

Deep dive into the out-of-the-box feature set

Show your audience you understand their routine and ensure they don’t waste time on trivial tasks. Attract merchants with the top-notch UI that streamlines and optimizes business processes for them. Help them achieve higher efficiency and reap the rewards of a quickly growing customer base and profits. Credit card processing software allows businesses to process payments efficiently, ensuring smooth and secure transactions.

Online POS

- Online POS registration

- Web-payments acceptance via:

- hosted payment page

- host-to-host integration

- Customisable checkout page

Payment initiation

- Send invoices and payment requests via:

- push notifications

- dynamic QR codes with POS data and transaction sum

- a payment link via email, messengers or SMS

Payment acceptance

- In-store payments:

- Via credit or debit cards

- from digital wallet

- from bank account

- Online payments (checkout page):

- by credit or debit cards

- from digital wallet

- from bank account

- Tips acceptance

Instant/Regular payouts

- Receiving settlement amounts to the merchant’s:

- bank account

- card

- mobile phone

- digital wallet

Receipts generation

- manually, from transaction history

- via sending email receipts after the transaction

Refunds initiation

- initiating refund transactions on the customer’s demand

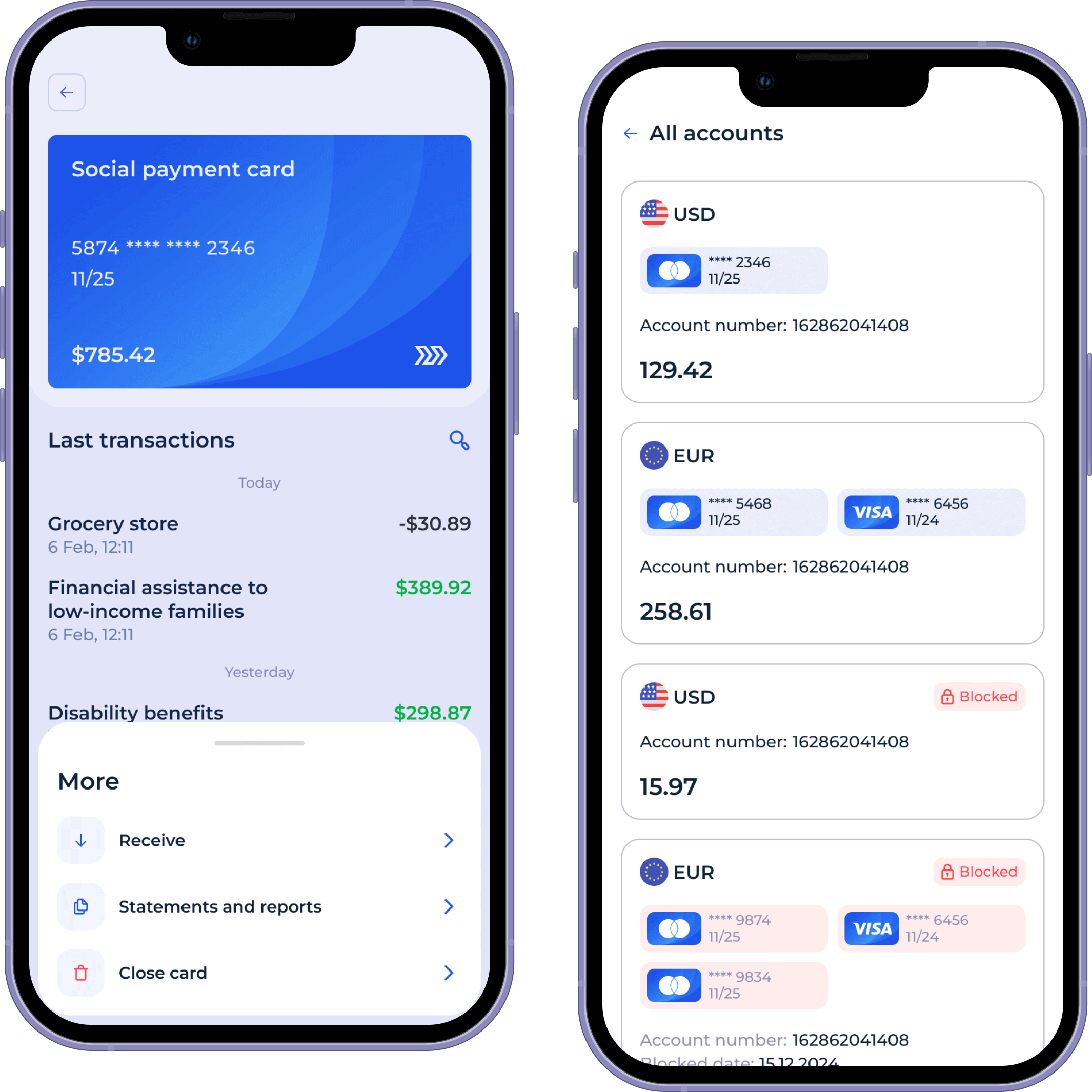

Merchant's digital wallet

- opening a digital wallet for the merchant’s personal use

Roles & permissions management

- individual

- merchant

- administrator

- accountant

- compliance manager

Out-of-the-box functionality to accelerate your time-to-launch

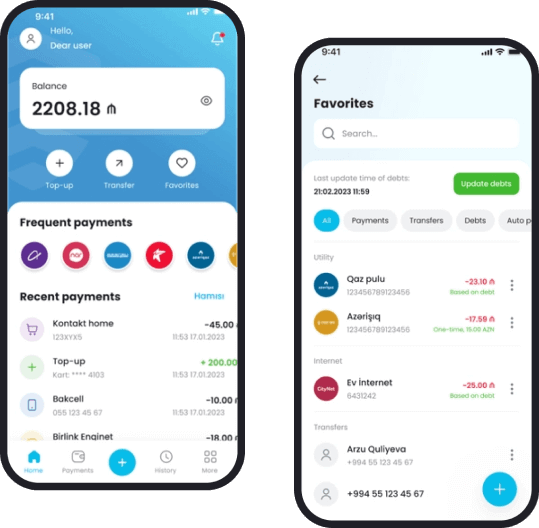

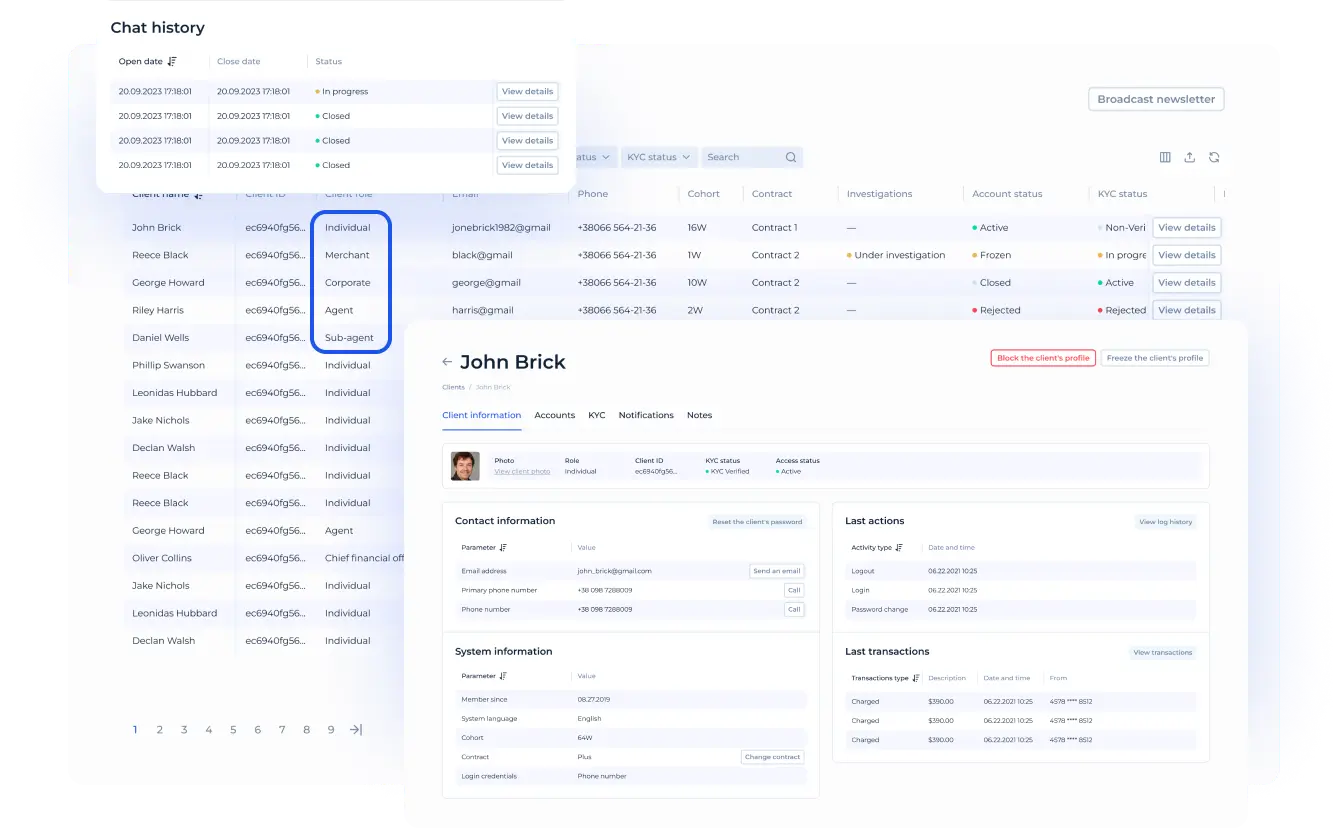

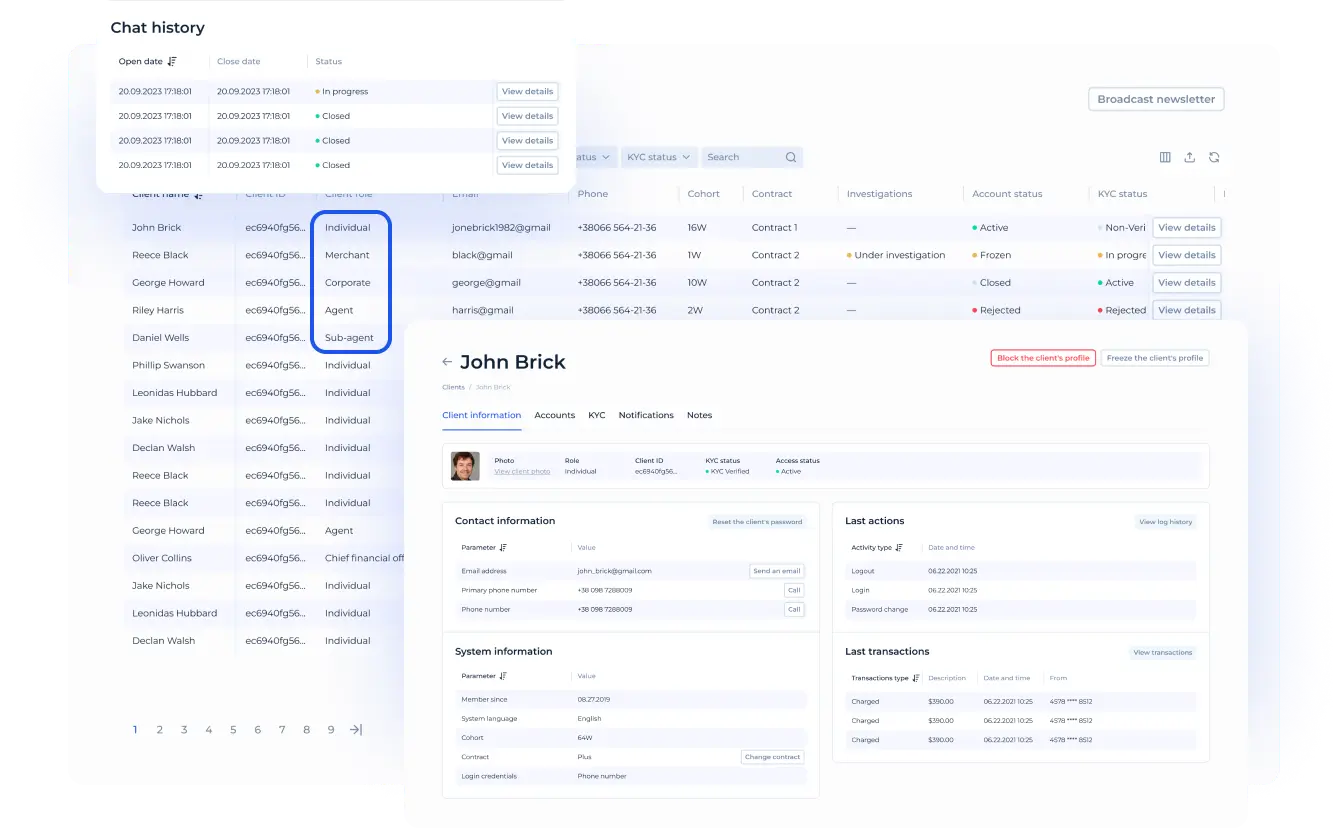

For individual & corporate clients

- Onboarding & 2FA (two-factor authentication)

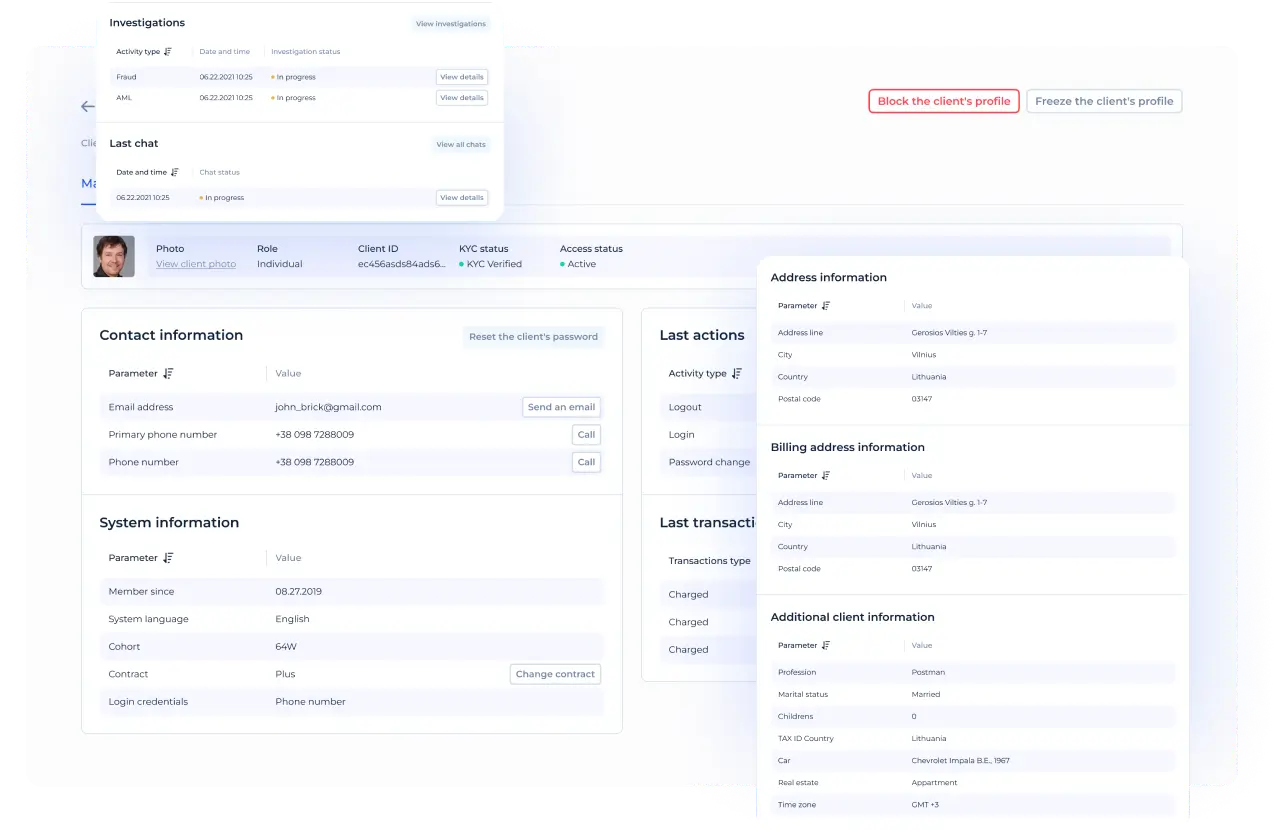

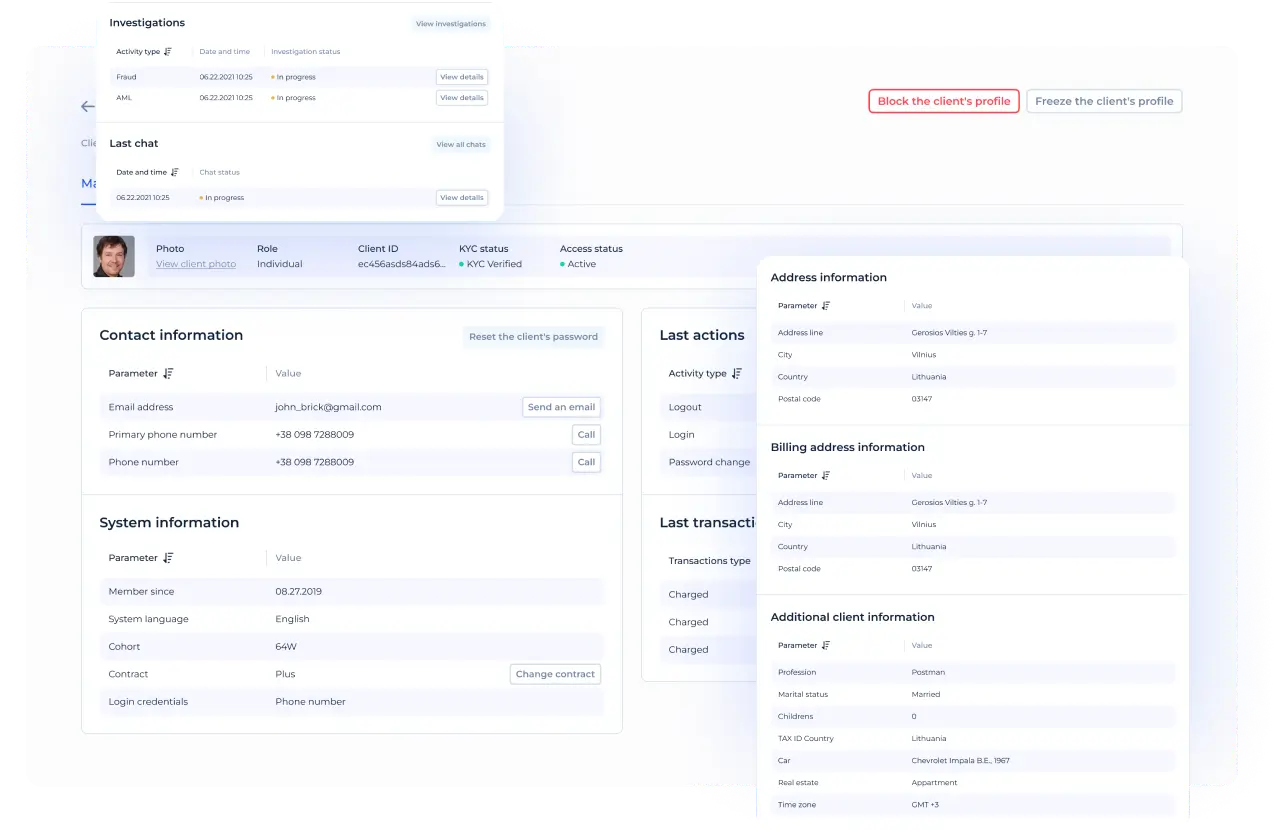

- Customer profile & settings

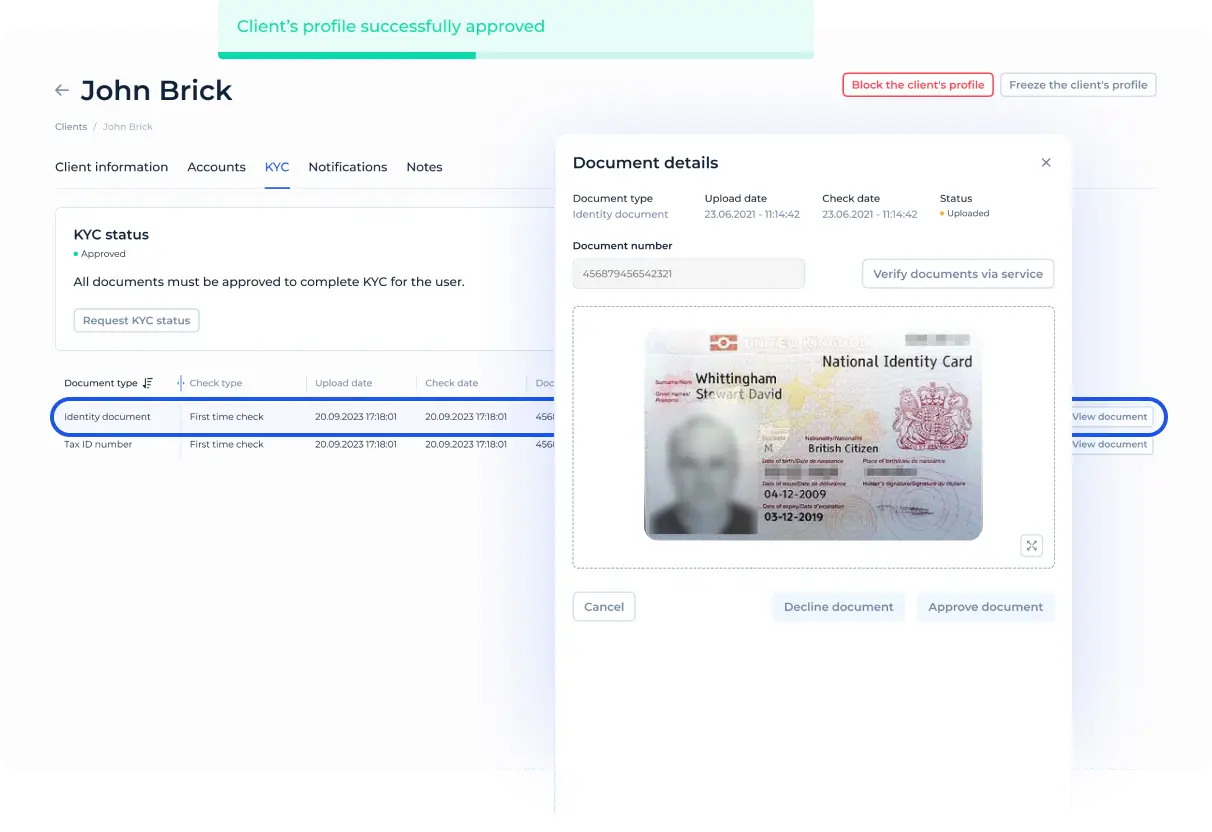

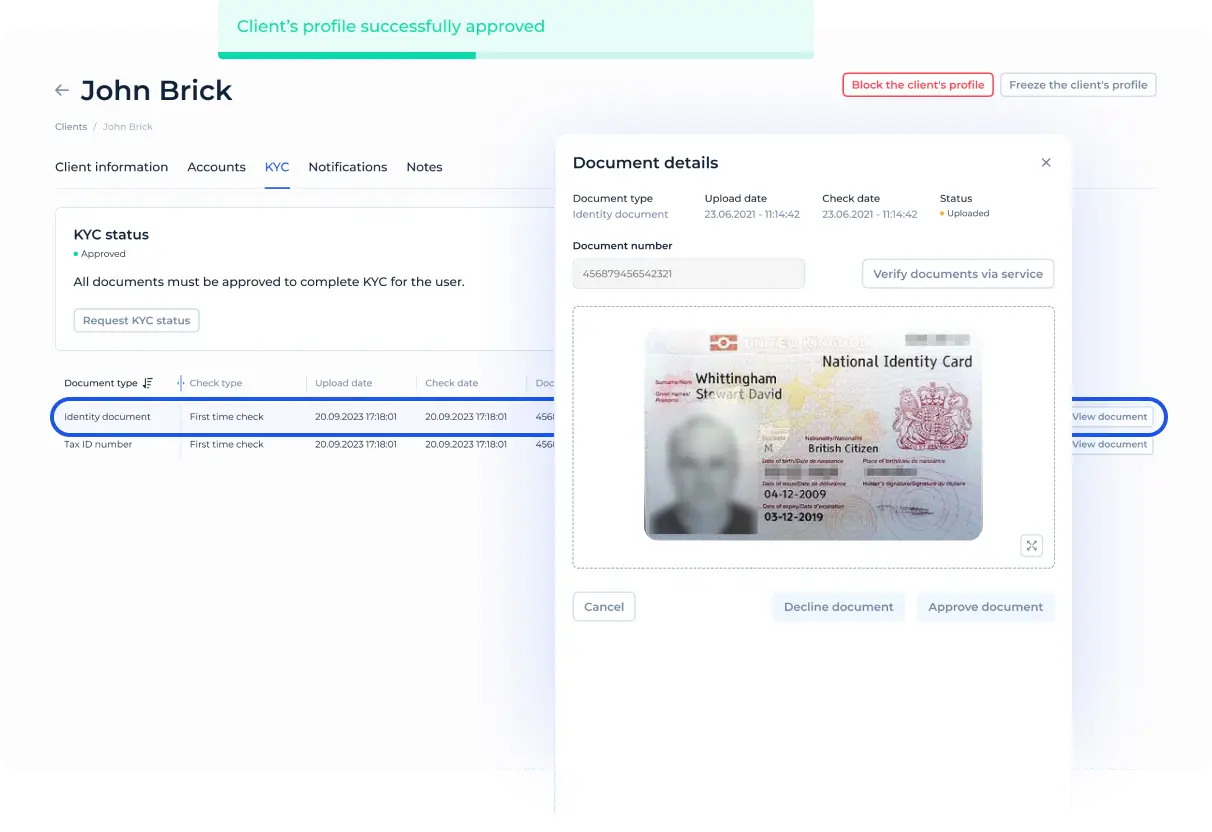

- Ongoing KYC/KYB with a trusted vendor

- Accounts in any currencies, crypto, points

- Cards & IBAN linked to accounts

- Real-time currency exchange

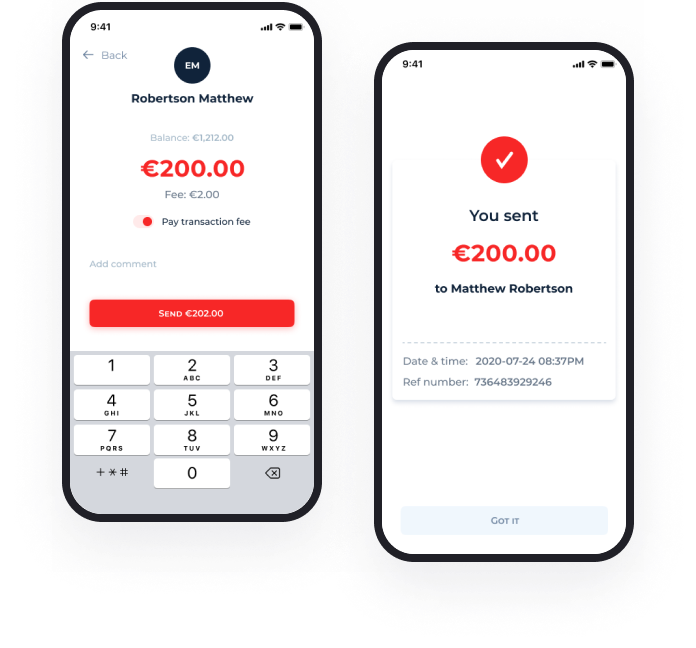

- Send, request, or exchange funds

- Payment links & QR code payments

- Operations with cash for clients (Cash points)

For merchants

- Payment acceptance offline (POS, QR codes)

- Payment acceptance online (gateway)

- Checkout page experience

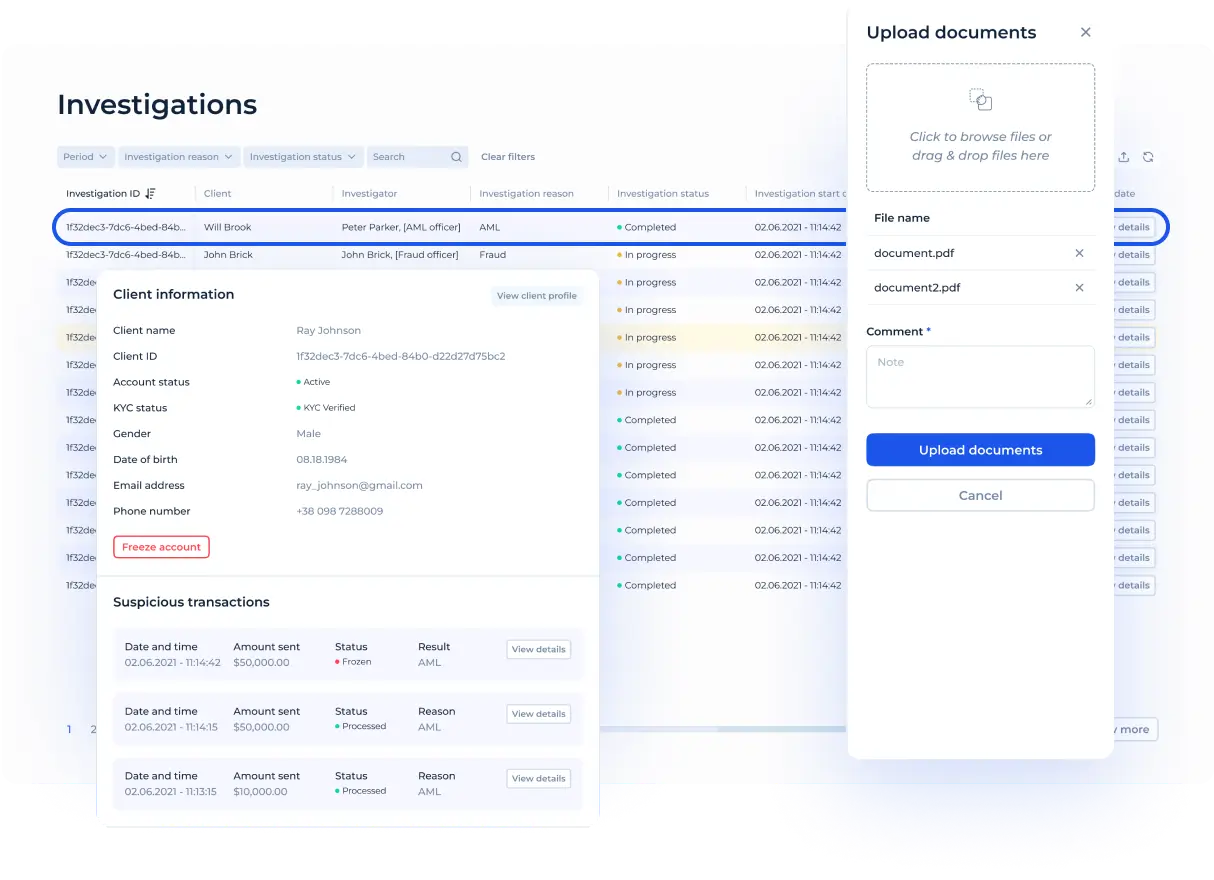

- Dispute resolution: refunds & chargebacks

- Reports

System management

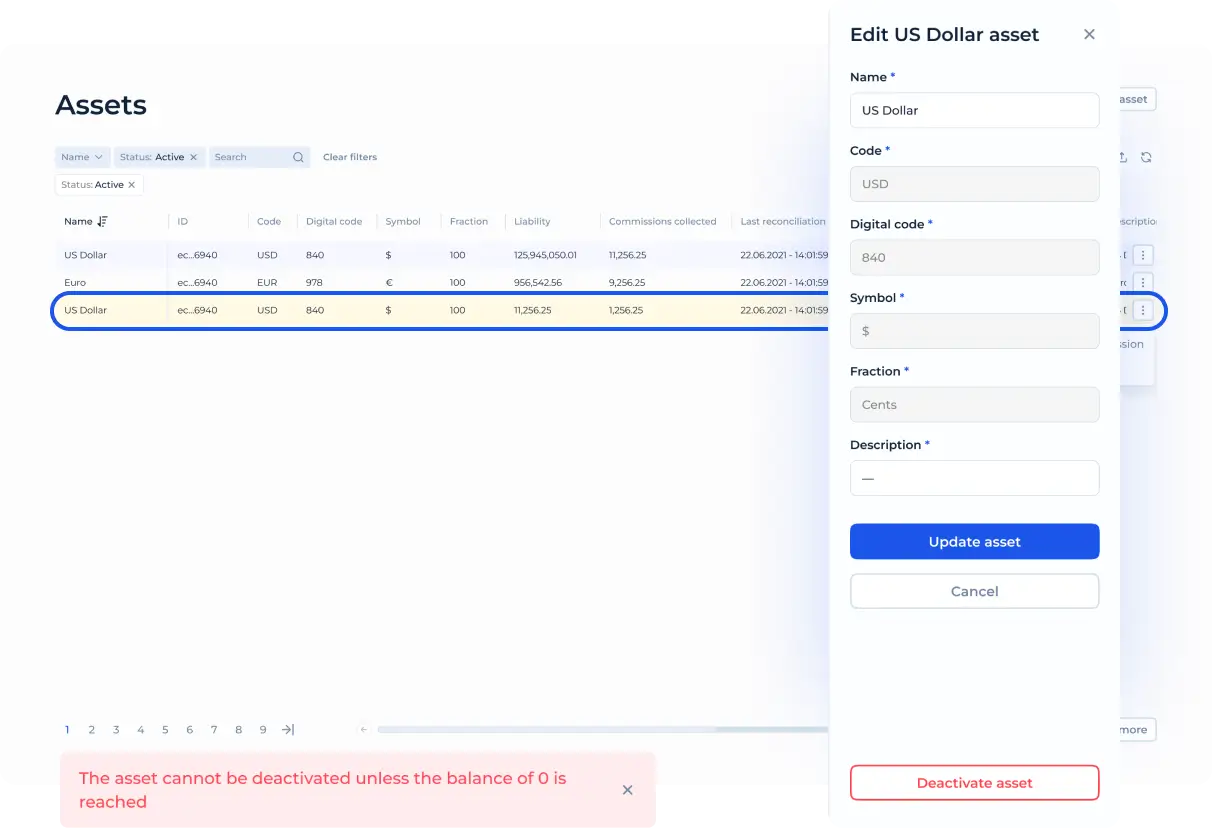

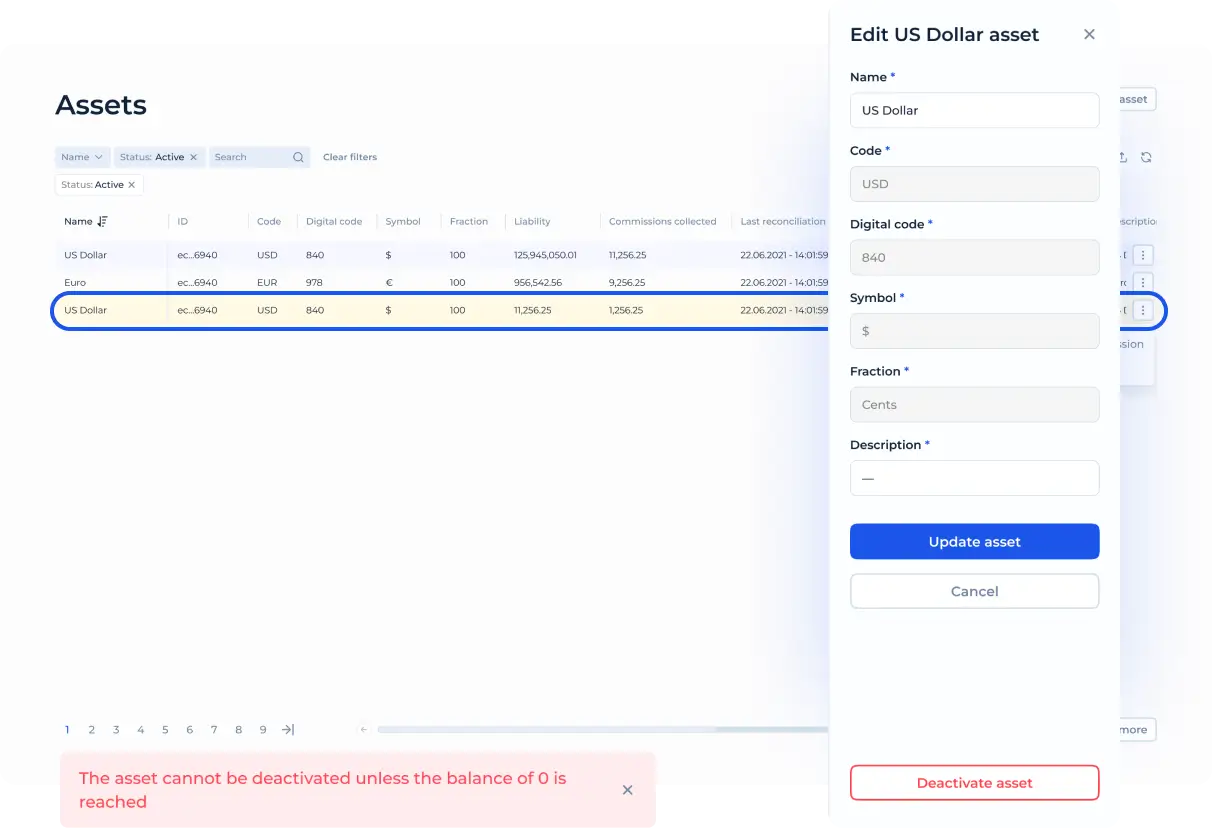

- Currency & assets creation engine

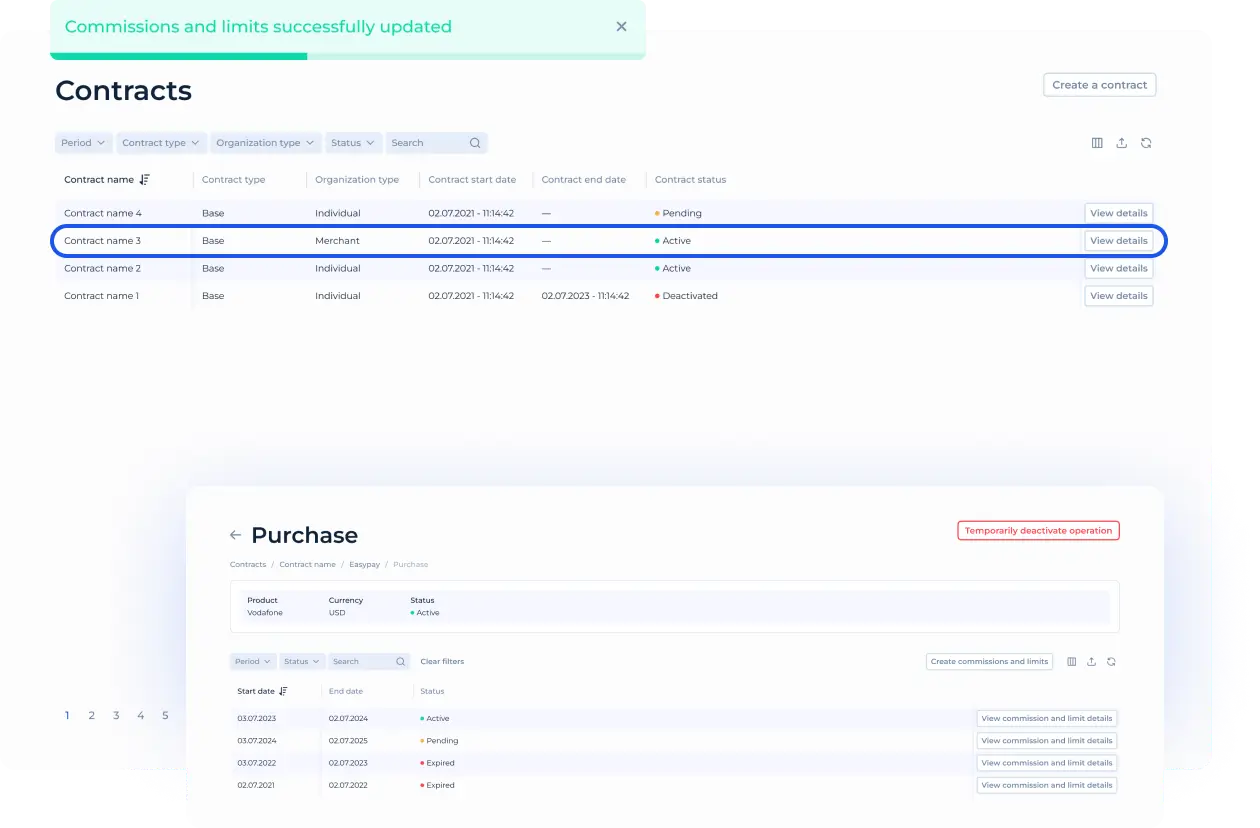

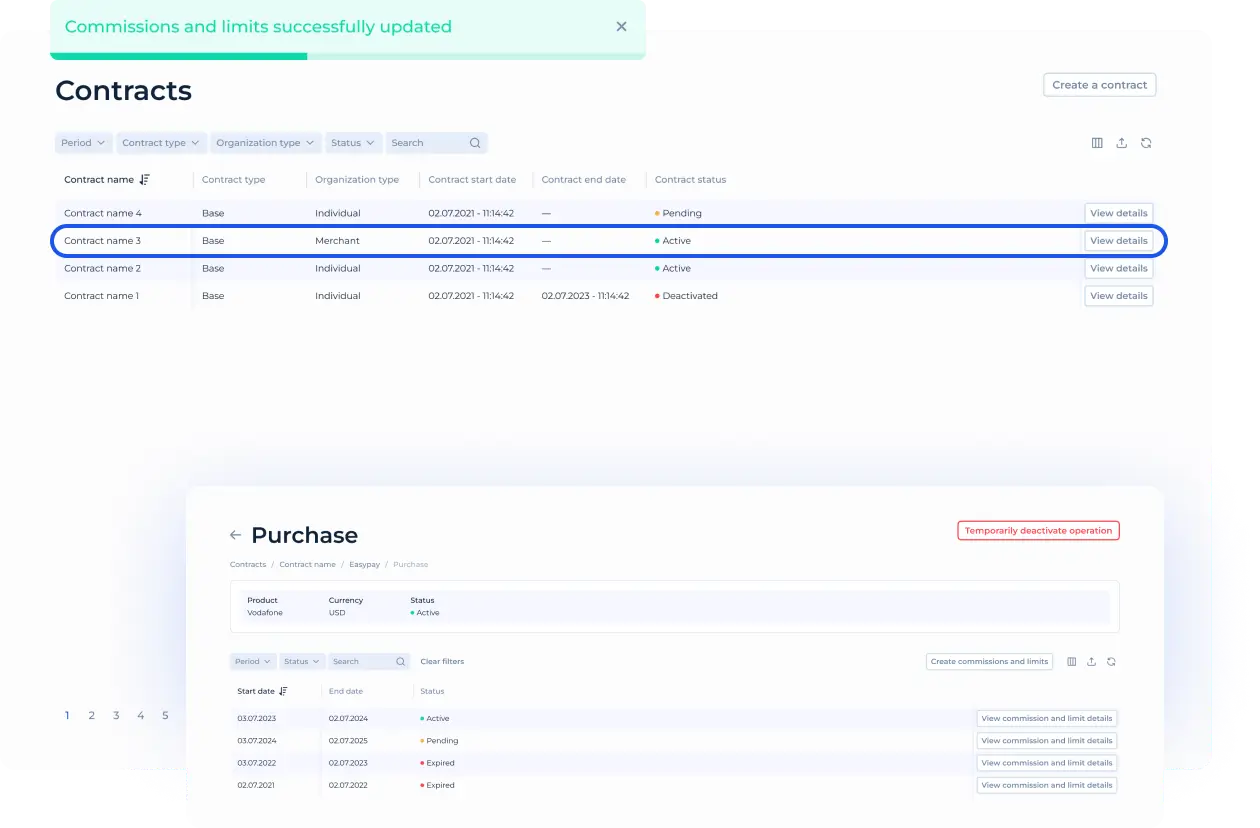

- Flexible fees & limits engine

- In-system CRM & chat with clients

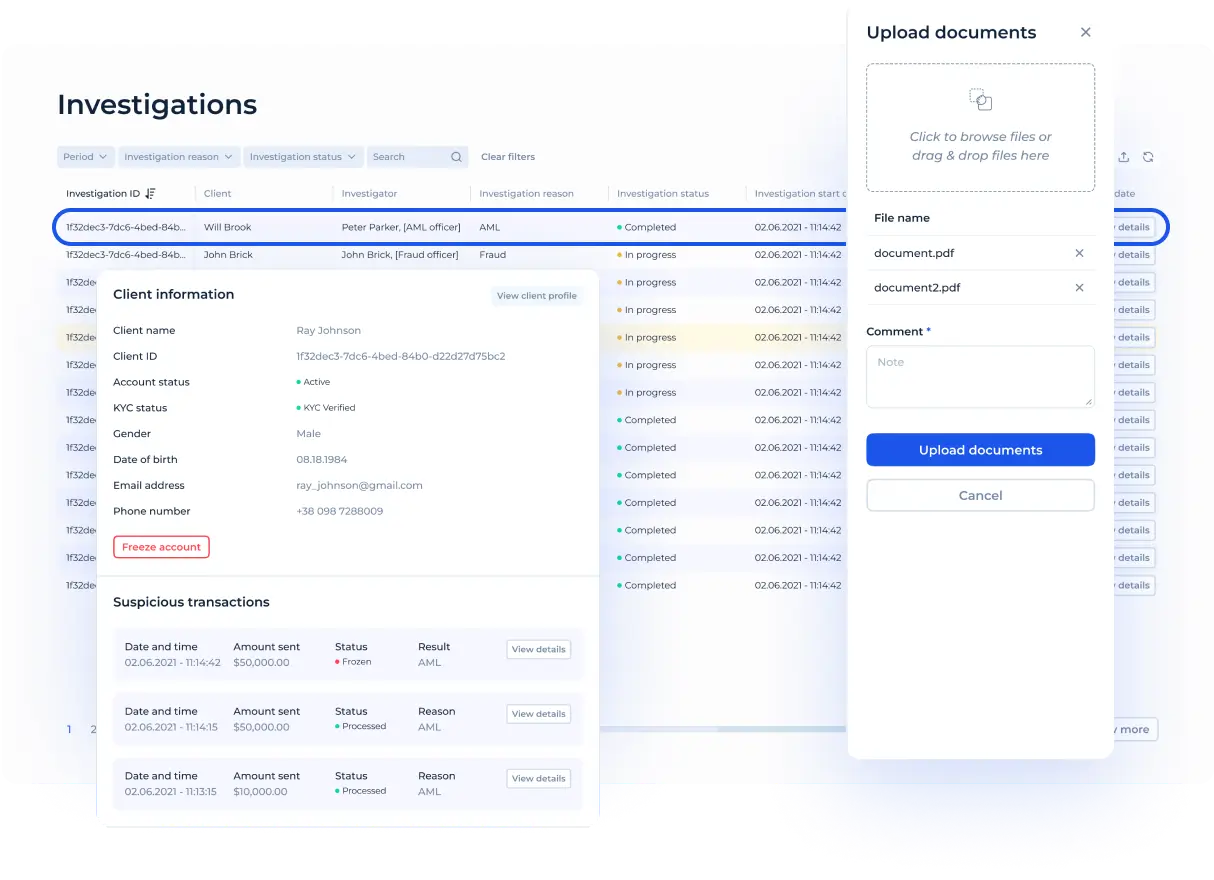

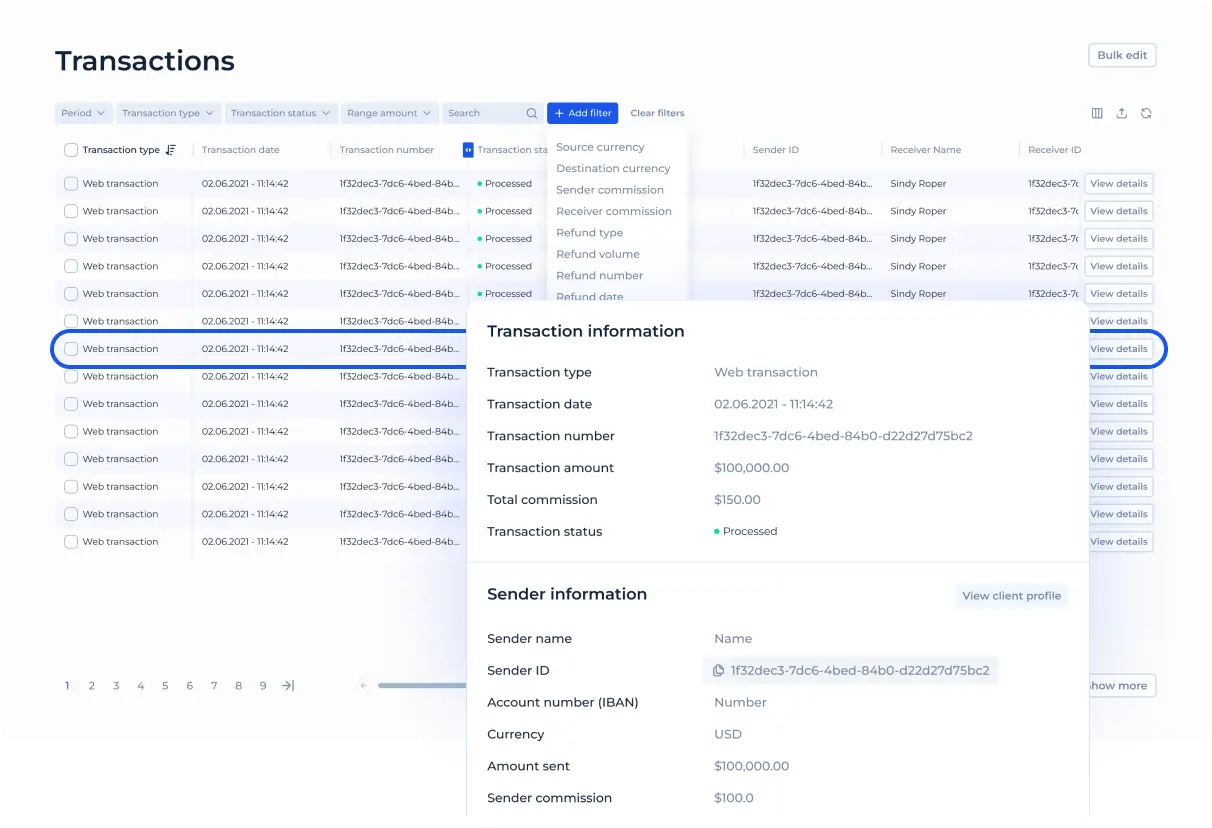

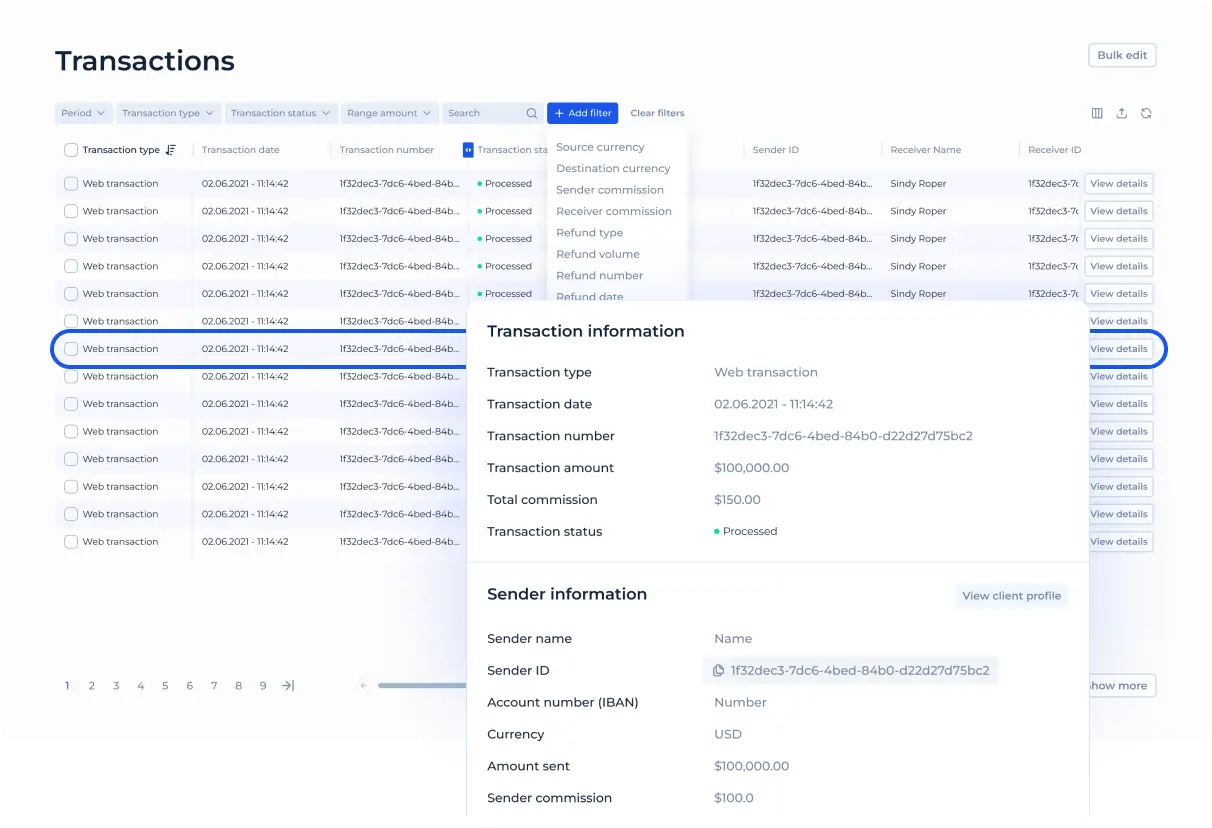

- Detailed transaction monitoring

- Flexible reporting

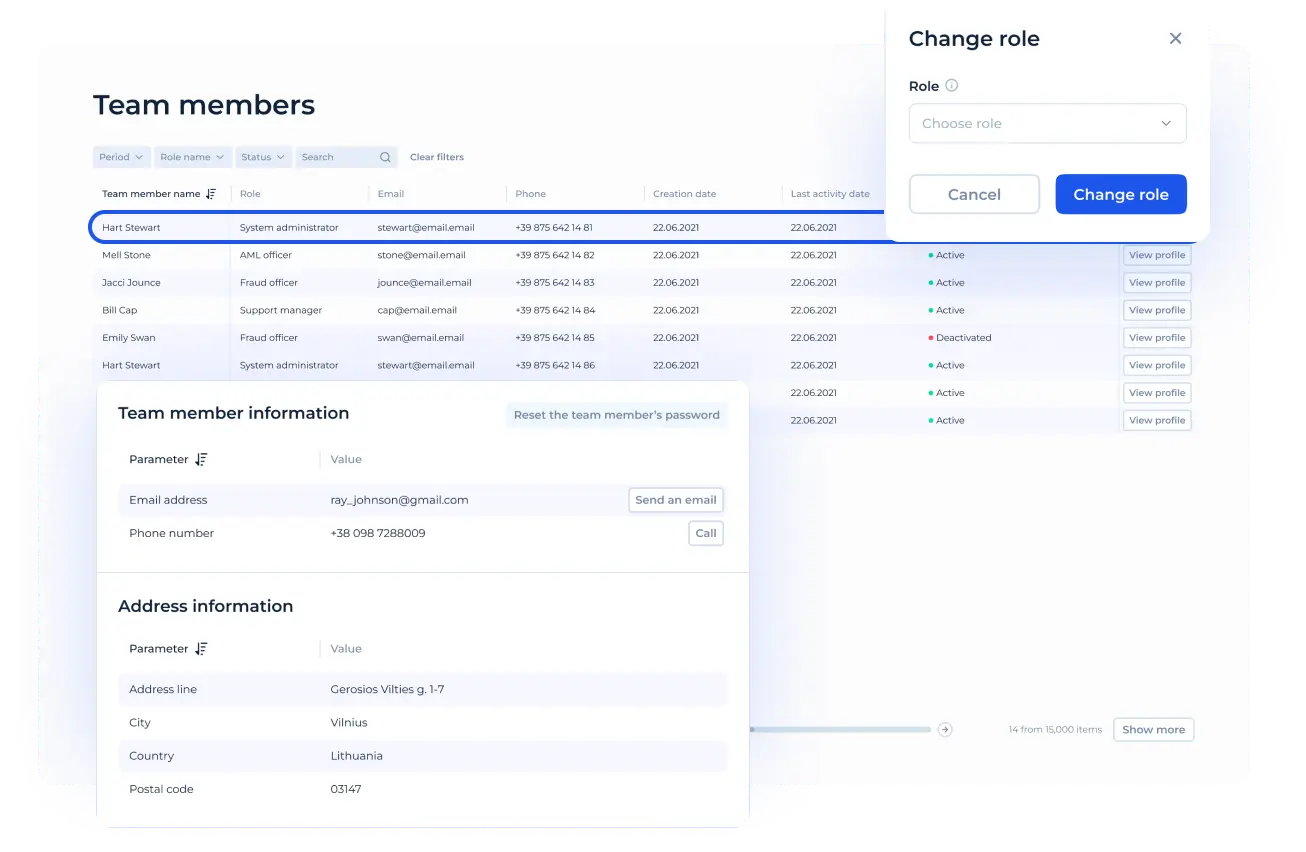

- AML/Anti-fraud officers’ workspace

- User action history

- Reconciliation & settlement section

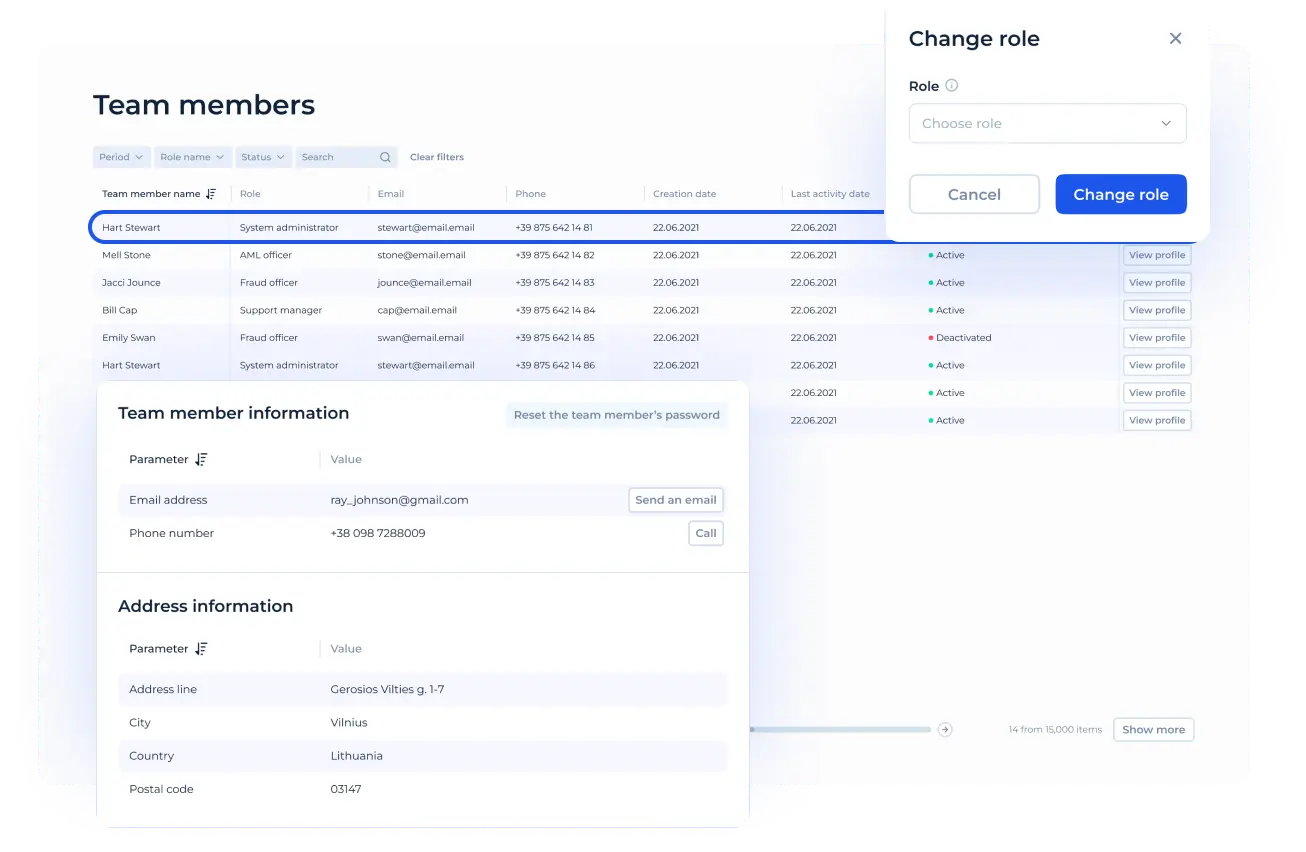

- Roles & permissions

Grow your profit

Get the most out of flexible transaction fees and limits configuration possibilities to maximize your revenue, plus attract and retain customers via personalized tariffs.

Diversified pricing

Manage payment fees apart from cards fees and wire transfers (SWIFT/SEPA) for maximum flexibility.

Personalized tariffs

Easily tweak pricing for the previously set up customer segments. Leverage individual tariffs to meet specific business contract terms

Impose money flow limits

Manage potential risk by activating turnover and transaction limits for specific merchant segments, based on the risk level.

Dynamic scalability

With a workload capacity from 2,700 TPS* (transactions per second), the SDK.finance system can handle over 230 million transactions per day. More information about technology.

2,700

transactions per second

34,5M

transactions per day

1B

transactions per month

12,6B+

transactions per year

Ready-to-use integrations

The SDK.finance payment processing software comes with pre-integrated providers for key functionalities such as payment acceptance, card issuance, and KYC/KYB compliance. This streamlined integration process ensures a hassle-free setup of your financial transactions. You can find more information about integrations here.

Become a payment service provider through the pre-developed processing software

Accelerated time-to-market

SDK.finance merchant payment processing solution offers a shortcut to the product development cycle, putting you right on the doorstep of offline or online processing product launch.

Flexible delivery

Choose a hybrid-cloud model for an affordable and quick launch, or the source code version for full control and independence from the vendor.

Simplified compliance

With source code access, tailor your solution to meet specific regulatory standards and ensure compliance across different jurisdictions.

Speed up your payment processing system development

With SDK.finance, you get everything to accelerate up your payment processing project launch and minimize development risks:

- Pre-developed backend

- Ready backoffice and mobile app

- Expert development team at your request

- Saved in-house team’s resources

Ready to get started? Get in touch with us!

Related products

Ewallet

AvailableDevelop and manage e-wallet solutions that empower customers to securely conduct transactions, and effectively monitor their expenses.

View product page

White-Label PSP Software for Payment Service Providers

AvailableGet a payment processing software for PSPs that need to build or expand a payment gateway, manage merchants, and control settlements without developing core infrastructure in-house

View product pageSDK.finance Payment Processing Software FAQs

What is payment processing?

Payment processing is the backbone of any transaction between a customer and a merchant, facilitating the exchange of goods or services for payment. This process involves several critical steps, including authorization, capture, and settlement, to ensure that payments are processed securely and efficiently. By streamlining these steps, payment processing software helps businesses accept payments seamlessly, whether through credit card payments, debit card payments, or online payments. This not only enhances the customer experience but also ensures that merchants can manage their cash flow effectively.

What is a payment processing system?

How payment processing systems work?

A payment processing system works by routing a transaction through several steps in real time: when a customer initiates a payment, the system captures the payment data and sends it to the acquiring bank or payment gateway, which forwards it through the relevant card network or payment rail to the issuing bank for authorisation. The issuing bank approves or declines the transaction based on available funds and risk checks, and the response is returned to the merchant within seconds. Once approved, the transaction moves to clearing and settlement, where funds are transferred between financial institutions and recorded in the ledger for reconciliation, reporting, and compliance.

How to choose the right payment processing solution?

Selecting the right payment processing solution is crucial for the success of your business. Key factors to consider include processing fees, payment gateway fees, and merchant account fees. It’s also important to evaluate the level of security and compliance offered by the solution, ensuring it meets standards such as PCI-DSS and SSAE 16 compliance. SDK.finance is PCI DSS Level 1 compliant, which is the highest level of certification in the Payment Card Industry Data Security Standard (PCI DSS). Look for a solution that provides a user-friendly interface, easy integration with your existing systems, and excellent customer support. By carefully considering these factors, you can choose a payment processing solution that not only meets the needs of your business but also helps you build a world-class brand capable of accepting credit cards and various other payment methods, including international payments and Apple Pay.

Can I request a demo of the SDK.finance payment processing software?

Yes, we offer video demos of the backoffice for your team and mobile app for your clients. Both are available there and then, no waiting. If you need more details or have any questions, do reach out to us and we’ll be in touch with you shortly.

Are there any location-related restrictions for using your payment processing software?

There aren’t location-related restrictions for using our payment acceptance software, because the SDK.finance Platform can be easily customized, which allows you to comply with the regulatory requirements. With the hybrid-cloud PaaS version, you manage and host the main database, which helps to adhere to the data localization regulations.

What tech stack is the SDK.finance payment acceptance platform built with?

SDK.finance uses the most advanced technology stack for building its payment processing software.

Is SDK.finance an open-source payment processing software?

The SDK.finance payment processing is available as a SaaS version or with the source code license.

Is SDK.finance payment processing software cloud-based or on-premise?

Our digital payment processing software is available in two variants:

- The subscription-based payment model is hosted on AWS. You get the app deployed on the cloud, the database is hosted on your own server for the sake of data localization compliance and security.

- An on-premise version comes with the source code license, available for a one-time flat fee.

Learn more about the details of the source code purchase.

Can I buy the payment processing platform source code?

To buy our payment processing software check out the code acquisition workflow for details. To buy the source code and get more details about the Platform, contact us.